Direct Indexing: Personalized Investing with Powerful Tax Advantages

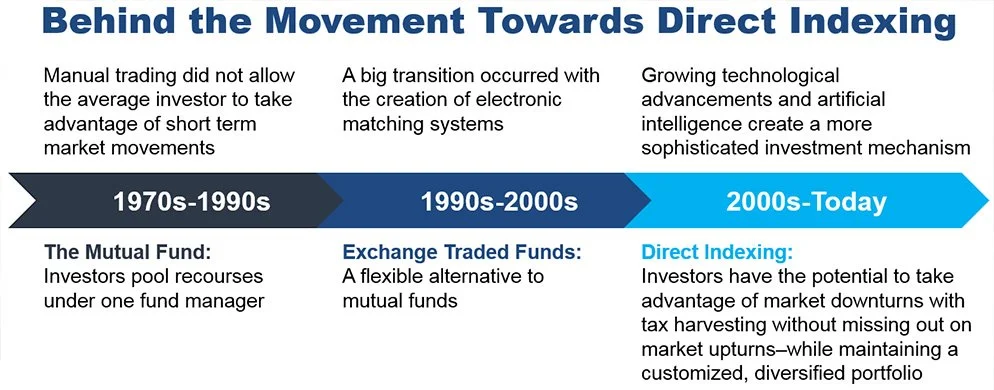

In today's investing world, customization and tax efficiency are more important than ever. One strategy growing rapidly among sophisticated investors is direct indexing — a modern alternative to buying traditional index funds or ETFs. Direct indexing offers the potential to boost after-tax returns, personalize portfolios, and take greater control over your investments.

What Is Direct Indexing?

Instead of buying a single index fund (like an S&P 500 ETF), direct indexing involves buying the individual stocks that make up the index directly in your own account.

This approach gives investors the ability to:

· Actively manage tax opportunities across the portfolio.

· Customize holdings based on personal preferences or values (like ESG screens).

· Adjust exposures to specific sectors, factors, or companies.

Key Benefits of Direct Indexing

1. Tax-Loss Harvesting Opportunities

One of the biggest advantages is the ability to harvest tax losses more efficiently.

When individual stocks in the portfolio decline, you can sell those specific stocks at a loss to offset other capital gains (or up to $3,000 in ordinary income each year).

Meanwhile, the overall portfolio can remain closely aligned to the benchmark, preserving your intended market exposure.

2. Personalized Portfolio Management

Direct indexing allows you to customize around your unique goals:

· Exclude certain companies or industries you don't want to own.

· Tilt toward preferred sectors or factors.

· Optimize around existing holdings to minimize concentrated positions.

3. Better After-Tax Outcomes

By continuously harvesting losses and minimizing gains, direct indexing can lower your tax bill year after year, potentially enhancing your after-tax, real-world return compared to owning a traditional fund.

4. Flexibility for High-Net-Worth Investors

For investors with significant taxable assets, direct indexing can be tailored around complex situations — such as managing around employer stock, charitable giving strategies, or preparing for estate planning transitions.

Who Benefits Most from Direct Indexing?

· Investors with large taxable accounts.

· High-income earners facing high marginal tax rates.

· Individuals seeking portfolio customization beyond cookie-cutter funds.

· Those interested in long-term, tax-sensitive investing.

Bottom Line

Direct indexing combines the best parts of passive investing — diversification, low costs, broad exposure — with the personalization and tax advantages traditionally reserved for active management.

In the right circumstances, it can be a powerful strategy to enhance returns, reduce taxes, and tailor your investments more precisely to your needs.

Quantifying the Estimated Tax Savings of Direct Indexing

Example Setup

· Portfolio size: $1,000,000

· Benchmark: S&P 500

· Expected annual volatility: ~15% (stock markets can swing up and down — individual stocks even more)

· Expected market return: 6%–8%

· Marginal tax rate: 37% federal + 3.8% net investment income tax = 40.8% combined

· Strategy 1:

o Traditional ETF (e.g., SPY, VOO)

o No tax-loss harvesting available inside the ETF.

· Strategy 2

o Direct Indexing — owning individual stocks.

o Actively harvesting losses on underperforming stocks throughout the year.

How Direct Indexing Creates Tax Savings

· In a typical year, even when the overall index rises, about 30%–40% of individual stocks will show a loss at some point.

· Direct indexing takes advantage of these losses by selling underperforming stocks to capture losses, then buying similar securities (to avoid wash sale rules and keep market exposure).

Industry estimates (from providers like Parametric, Aperio, and others) suggest:

· Annual harvested tax losses from direct indexing typically range between 1% and 2% of portfolio value.

· Tax savings = harvested losses × marginal tax rate.

Estimated Annual Tax Savings

Let’s run numbers:

· Harvested losses: 1.5% of $1,000,000 = $15,000 of losses.

· Tax rate: 40.8%

· Tax savings:

$15,000 × 40.8% = $6,120

✅ Annual estimated tax savings = ~$6,000 per year

Compared to an ETF (Non-Direct Indexing)

· With an ETF, you cannot selectively harvest losses inside the fund.

· You can only harvest when selling the whole ETF — but most investors are holding.

· Result: $0 in regular harvested losses during most years from an ETF alone.

Important Caveats

· Savings vary depending on market conditions: higher volatility → more harvesting opportunities.

· Bigger portfolios amplify savings.

· If you eventually realize gains (e.g., when selling stocks in the future), you may face taxes later — but deferral still has value.

· Tax harvesting is most powerful for high-income investors and in volatile markets.